Understanding the Details of an antenuptial contract

Antenuptial Contracts Explained: Exactly How They Can Benefit Your Future Together

Antenuptial agreements work as important legal tools for pairs getting ready for marital relationship. They define how possessions and obligations will certainly be handled, promoting quality in economic issues. These contracts can be especially advantageous in protecting individual passions and assisting complicated household dynamics. Understanding their value may elevate concerns about just how they can form a pair's future. What certain benefits could an antenuptial agreement offer in your unique situation?

What Is an Antenuptial Contract?

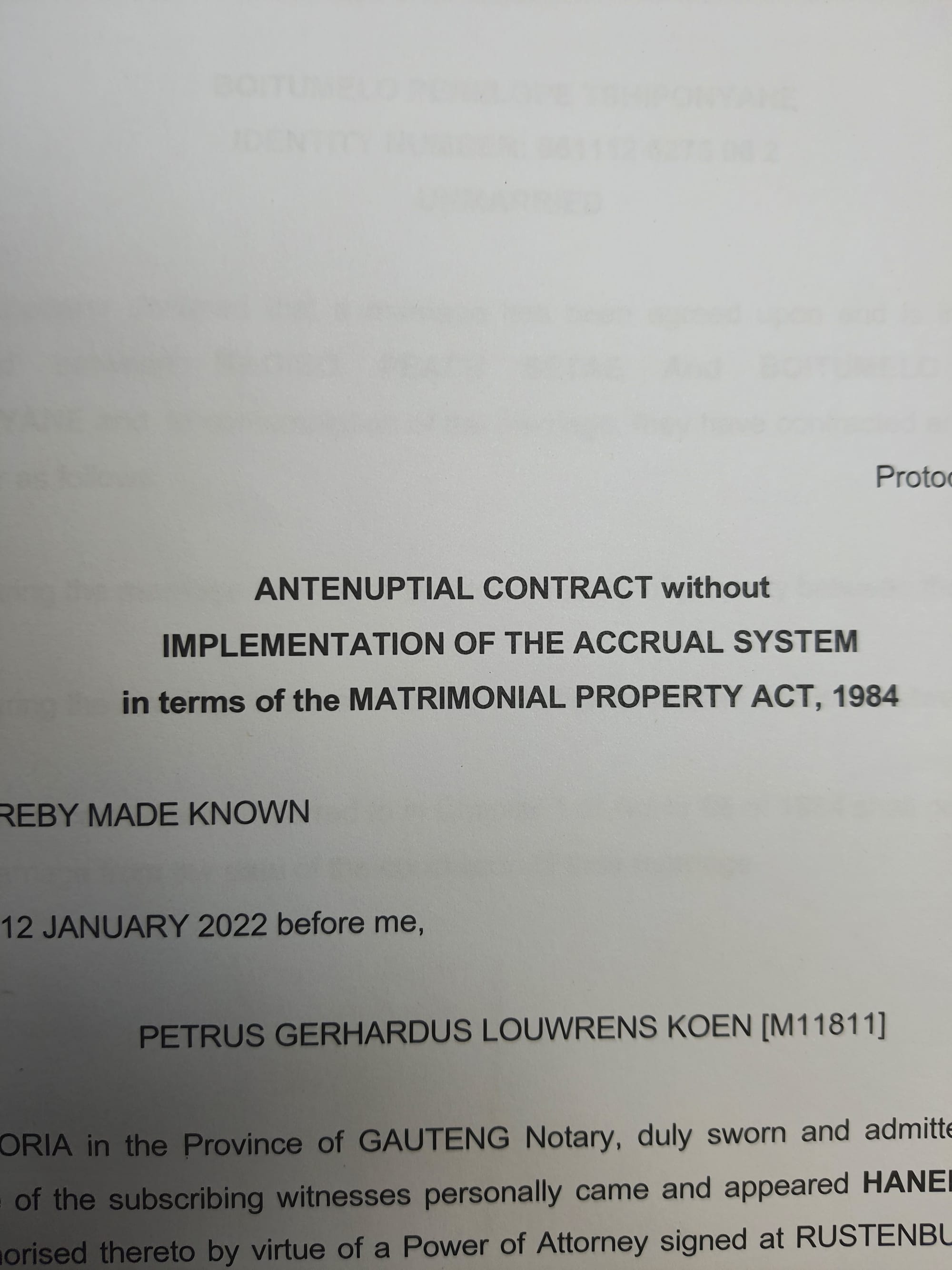

An antenuptial agreement, usually described as a prenuptial contract, is a legal document developed by 2 individuals prior to their marital relationship. This contract describes the management and department of possessions and obligations in case of separation or death. Generally, it includes stipulations relating to residential property legal rights, spousal support, and inheritance. The key function of an antenuptial contract is to develop clear expectations and shield each celebration's monetary interests. It can additionally help to minimize problem ought to the marital relationship end. While typically connected with well-off individuals, such contracts can benefit pairs of varying monetary histories. By dealing with possible concerns beforehand, an antenuptial contract can offer both events with comfort as they get in right into their marriage.

The Relevance of Financial Transparency

Financial transparency is essential in any kind of connection, specifically when preparing an antenuptial agreement. Open communication concerning finances allows both partners to comprehend each various other's responsibilities and assets completely. This clearness can considerably reduce the possibility for monetary conflicts in the future.

Open Up Interaction About Finances

How can pairs navigate the complexities of their monetary lives without open communication? In relationships, transparency concerning finances fosters count on and understanding. When partners freely discuss their monetary circumstances, objectives, and problems, they develop a strong foundation for common decision-making. This discussion assists protect against misunderstandings and constructs a sense of synergy in handling finances. Couples ought to establish a routine for discussing monetary issues, enabling them to attend to any type of concerns before they escalate. By discussing and establishing clear assumptions investing routines, cost savings goals, and debt management, companions can align their financial concerns. Eventually, open interaction about finances not just enhances the relationship however likewise prepares pairs for future difficulties, ensuring they are on the exact same web page as they navigate their economic trip together.

Comprehending Each Various other's Possessions

While guiding with the intricacies of a shared economic future, recognizing each various other's assets ends up being important for pairs. Financial transparency promotes depend on and lays a solid structure for the relationship. By freely discussing their specific assets, partners can better appreciate each other's financial backgrounds, strengths, and susceptabilities. This understanding helps in aligning their economic goals and assumptions, developing a unified method to budgeting and financial investments. Couples that identify the worth of their consolidated properties are most likely to make enlightened decisions regarding residential property, financial investments, and savings. Inevitably, this clarity not only enhances shared regard but also prepares couples to encounter potential financial challenges together, making sure a more harmonious and secure collaboration relocating onward.

Decreasing Economic Conflicts Later

Open interaction concerning finances can substantially reduce the capacity for disputes later on in a connection. Antenuptial agreements act as a foundation for this transparency, plainly laying out each partner's economic responsibilities and assumptions. By discussing properties, financial debts, and revenue honestly, pairs establish trust fund and understanding, decreasing misconceptions that can result in disagreements. Financial openness allows both people to articulate their goals and concerns, promoting collaboration instead of competitors. This aggressive technique not only strengthens the partnership but additionally furnishes pairs to navigate future financial difficulties with greater ease. Eventually, embracing economic openness through an antenuptial contract motivates a healthier, more resistant relationship, where both companions feel secure in their common financial trip.

Safeguarding Specific Possessions and Inheritances

Antenuptial contracts act as important devices for protecting private possessions and inheritances. They specify separate residential or commercial property and establish clear strategies for inheritance security, ensuring that individual riches remains unique throughout marriage. Additionally, these arrangements provide clearness regarding asset department, which can protect against conflicts in the event of a splitting up.

Defining Separate Residential Property

Comprehending the concept of separate building is basic for people wanting to secure their specific properties and inheritances within a marital relationship. Different residential or commercial property refers to possessions had by one partner before marital relationship or gotten by gift or inheritance throughout the marital relationship. This category is considerable as it assists define which properties continue to be independently owned and are exempt to department during divorce process. To assure properties are recognized as separate residential property, documents and clear interaction are vital. Antenuptial agreements can clearly define these assets, shielding them from potential cases by the various other partner. By establishing different property, people can preserve control over their economic future and protect household traditions, guaranteeing see this page that individual financial investments and inheritances stay intact.

Inheritance Protection Techniques

Safeguarding individual properties and inheritances requires a tactical approach, specifically for those that desire to preserve their financial independence within a marital relationship. Antenuptial agreements work as an essential device hereof, enabling individuals to define how assets obtained prior to and during the marital relationship will certainly be dealt with. By clearly describing the possession of inheritances, these contracts guarantee that such properties remain different, protecting them from potential insurance claims by a partner in case of separation or death. In addition, pairs can attend to future inheritances, designating them as different residential property. This positive step not just safeguards specific wide range however also promotes openness and trust, permitting both partners to enter the marriage with a clear understanding of their monetary boundaries and responsibilities.

Property Division Clearness

Clarity in asset department ends up being crucial for couples looking for to preserve their monetary passions and individual properties during a marriage. Antenuptial agreements serve as an important tool in this procedure, laying out the ownership of assets and expectations regarding their circulation in the event of a separation or separation. By clearly recognizing which possessions are considered individual and which are joint, couples can mitigate possible disputes and misunderstandings. Additionally, these contracts can guard inheritances, making certain that family members traditions stay intact and safeguarded from division. By establishing clear standards for possession department, pairs can foster a sense of safety and count on, ultimately adding to a more harmonious marriage partnership while planning for any type of unforeseen circumstances.

Clarifying Financial Responsibilities and Expectations

How can couples guarantee a shared vision of their financial future? Antenuptial contracts function as a beneficial device for developing clear economic responsibilities and expectations. By plainly defining duties regarding earnings, expenditures, and savings, pairs can decrease misunderstandings. Such contracts can outline how joint and specific financial debts will certainly be taken care of and define payments to shared expenditures, developing a clear monetary framework. Furthermore, these agreements can resolve future economic goals, guaranteeing both celebrations are aligned in their desires. By establishing these specifications ahead of time, couples can cultivate open communication concerning funds, eventually strengthening their collaboration. This aggressive strategy not only alleviates prospective problems yet likewise advertises a collaborative financial trip together.

Browsing Complicated Family Situations

When confronted with complex household circumstances, couples may locate that antenuptial contracts provide important guidance. These contracts can resolve problems such as blended households, where youngsters from previous relationships may have varying cases to assets. By clearly defining possession and distribution of property, pairs can minimize dispute and secure the interests of all celebrations entailed. Additionally, antenuptial contracts can resolve obligations toward children from prior marital relationships, ensuring that monetary commitments are clear and set. In scenarios entailing substantial household wide range or company rate of interests, these agreements can safeguard possessions and make clear intentions. Ultimately, antenuptial contracts work as a proactive step, promoting harmony and understanding in households managing complex characteristics.

Preparing for Future Changes and Uncertainties

As life is inherently unforeseeable, pairs often find it important to get ready for future adjustments and unpredictabilities with antenuptial contracts. These arrangements function as aggressive actions, permitting companions to detail their economic obligations and expectations ought to unexpected situations arise. Elements such as occupation More Bonuses modifications, health issues, or family dynamics can greatly impact a partnership. By attending to these possible scenarios in development, couples can foster open interaction and enhance their commitment to every various other. Additionally, antenuptial agreements can assist reduce disputes and safeguard specific rate of interests during challenging times. This degree of preparedness not just supplies tranquility of mind but additionally enhances the structure of the partnership, making sure that both partners feel protected and valued regardless of what the future might hold.

How to Produce a Reliable Antenuptial Agreement

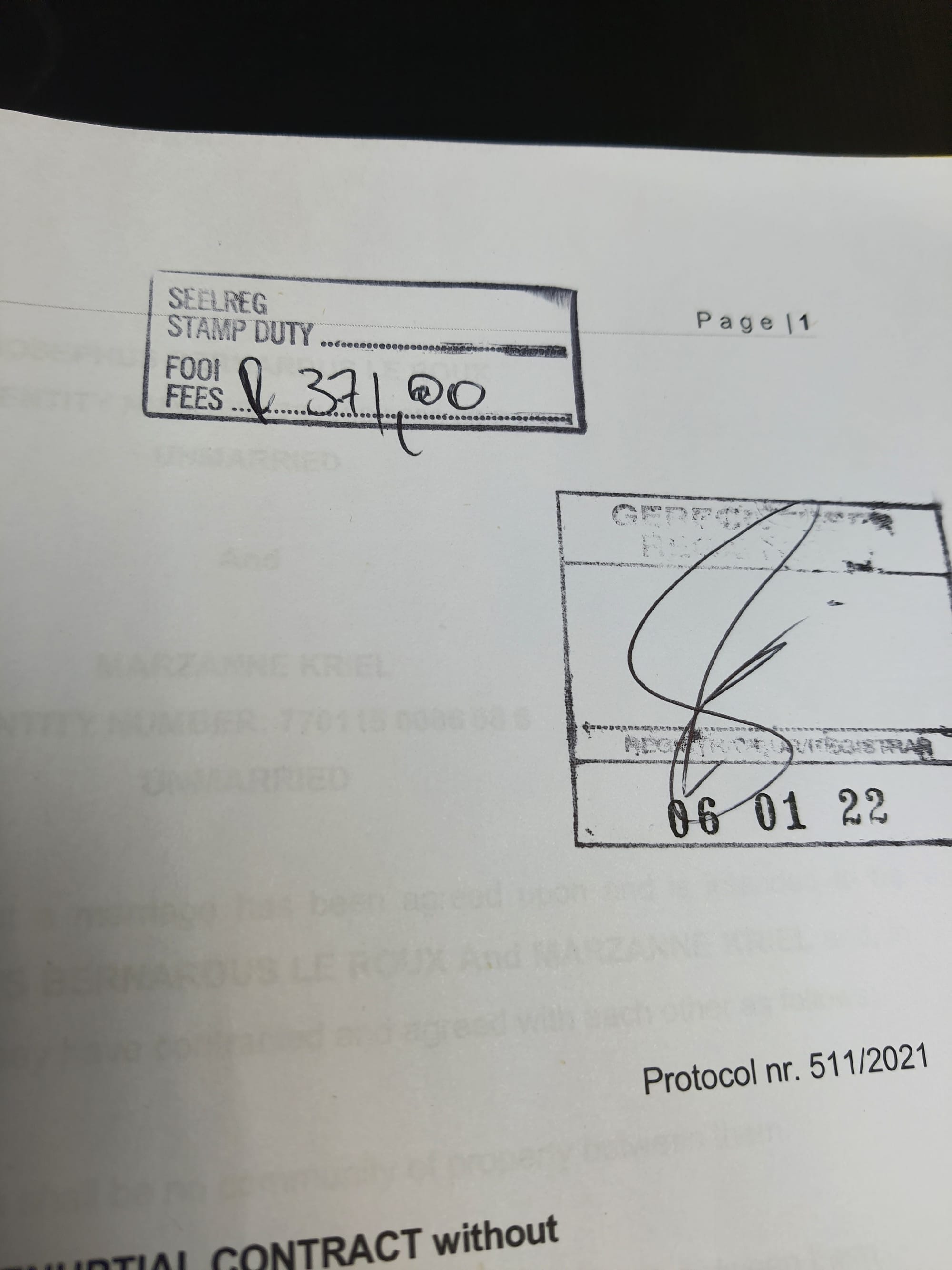

Producing a reliable antenuptial contract needs mindful consideration and clear interaction between companions. At first, both individuals must honestly discuss their financial situations, consisting of properties, financial obligations, and future monetary goals. Engaging a qualified lawyer focusing on family members legislation is essential to assure the contract conforms with lawful criteria and addresses significant issues. The contract must lay out property division, spousal assistance, and various other monetary setups, ensuring both parties' rate of interests are safeguarded. Furthermore, it is vital to revisit and update the agreement occasionally, especially after significant life changes such as the birth of youngsters or changes in income. By fostering transparency and common regard, partners can create a complete antenuptial contract that lays a strong structure for their future with each other.

Often Asked Concerns

Can an Antenuptial Contract Be Customized After Marriage?

An antenuptial agreement can possibly be changed after marital relationship, but this generally requires mutual consent from both events and might include legal processes to guarantee enforceability, relying on jurisdiction and particular situations surrounding the arrangement. (antenuptial contract)

What Happens if We Don'T Have an Antenuptial Contract?

Without an antenuptial agreement, couples default to their jurisdiction's marital home laws. This can bring about prospective conflicts over asset department and monetary duties throughout marriage and find here in case of splitting up or divorce.

Are Antenuptial Agreements Lawfully Binding in All States?

Antenuptial agreements are lawfully binding in many states, provided they satisfy certain demands such as voluntary contract and complete disclosure of assets. However, enforceability may differ based on state regulations and individual conditions.

Just how much Does It Typically Expense to Develop One?

Producing an antenuptial agreement generally sets you back in between $1,000 and $3,000, relying on factors such as complexity, lawyer fees, and location - antenuptial contract. Pairs should consult legal specialists to obtain precise price quotes based upon their particular demands

Can We Consist Of Non-Financial Agreements in the Contract?

Yes, non-financial agreements can be consisted of in an antenuptial contract. Couples commonly outline assumptions concerning family responsibilities, child-rearing viewpoints, and other personal dedications, making certain clarity and good understanding in their connection.

The main objective of an antenuptial agreement is to develop clear assumptions and protect each party's financial rate of interests. antenuptial contract. Financial openness is crucial in any relationship, especially when preparing an antenuptial agreement. Antenuptial contracts serve as a foundation for this transparency, clearly describing each companion's monetary obligations and expectations. Antenuptial contracts serve as a valuable tool for developing clear monetary duties and assumptions. Such agreements can detail exactly how joint and individual financial debts will be taken care of and define contributions to shared expenditures, developing a clear financial structure